CBS-CTS Integration & Outward Cheque Clearing Centralisation (HO/SO)

• Cheques that belong

to Other Banks presented in POSB and other SB Account types in are dealt in

Outward clearing.

• These cheques are

presented for Opening of new account (MIS/TD/KVP/NSC/SCSS/RD) or for credit into

POSA account or for subsequent deposits

in RD/SSA/PPF accounts.

• Cheques presented for

Non POSB operations are also dealt in Outward clearing

• Currently these

cheques are scanned in CTS (Origin) application and POSB Operation cheques lodged

in Finacle outward zone.

• Other branch cheques

are dealt directly in Treasury branch after completion of CTS Process.

• Cheques collected for

POSB operations and other branch cheques in SO are sent to concerned HO.

• These cheques are

scanned in CTS application at HO

• POSB branch cheques

are lodged in Finacle in Outward clearing zone

• On receipt of

clearance intimation from Grid, the zone is regularised and the credits are made

available in 0382 or SB account.• Other

Branch cheques are accounted in Treasury Branch

Outward Clearing Centralisation

-Advantages

• Outward cheque

regularisation is done by Nodal Office

(Chennai GPO).

• Credits in POSB

account /0382 will be in T+1 in case of

HOs and T+2 in case of SOs.

• Remittance

Adjustments – OHO adjustments are not

required as entire credits and debits are done at Nodal Office.

Revised

Process

• Cheques that belong to other banks collected

in HO for POSB operations alone to be

scanned in CTS application on same day.

• In case of non availability of scanners, the

HO should ensure that the cheques are scanned using their login ID and MICR.

Cheques should not be sent from one branch to other branch for scanning which causes

delay in Crediting.

• Post CBS-CTS Integration, CTS url will be accessible on SIFY network only .

• Only CBS Post Offices (Sub Office/BO)

cheques are to be scanned on day of receipt at HO by the Concerned HO.

• Cheques collected for Non POSB operations

viz PLI, Mails, Stamps, BPC, SGB etc and

Non CBS Post Office cheques are to be cleared through their HO’s associated bank

Account. These cheques are not to be scanned in CTS application .

• Data entry to be done in CTS application for

the POSB cheques which are scanned.

• Cheques are not to be lodged in Finacle.

Outward clearing zone could not be opened in Finacle.

• Validations have been

built in CTS application to validate SB account number and office account in which

the cheque amount is to be credited.

• Closed/frozen/dormant

account numbers could not be entered in

CTS application.

• Post Offices will not

be able to complete data entry, if error is thrown in Account Number and the respective

cheque has to be deleted.

• Allowed office

accounts – 0382/0322/BDPVT/0410

• HOs to ensure that

appropriate (HO or SO) sol id is entered for office account (0382).

• In case of office

account (0410) only HO sol id is to be used. Sub office 0410 office should not be used.

• In case of PPF/SSA, if the account stands in same sol, cheques can be lodged in 0382 of concerned sol even if

the amount is greater than Rs.50,000/-.

•

In case if the account stands in other sol, cheque to be lodged in 0382 of HO ONLY.

• Post cut off time

(17:00 hrs), CTS application will generate gridwise outward file for uploading in CTS

application.

• Nodal Office (Chennai

GPO) will upload these outward files against respective grid sol id i.e. Chennai GPO,

Mumbai GPO and New Delhi GPO as

settlement will happen against respective Grids.

• Release to shadow

balance will be done on same day of lodging outward cheques

• Nodal office will regularise the outward

clearing zone post receipt of outward

rejections on next day.

• On regularisation of outward zones, credits

will be available either in POSB account or in office account (0382/0322/BDPVT) of concerned HO or SO and

0410 of HO.

• Hos can login to CTS application and check

outward clearing status on next

working day.

• All POs to check the credits in 0382 office

account daily. If credits are

available for the cheques sent for clearing.

• Post offices to ensure that new accounts re

opened on same day of credit

availability in 0382 office account

• Post offices can

download PO Clearing (Detailed/Summary)

reports in Finacle by entering zone

date and zone sol id (60000100 /40000100 / 11000000) and obtain the details of the cheque by searching the Cheque number in the report

• Nodal Office will

account Remittance to Bank figures in CSI-SAP in respective account heads.

Refined Process – Outward

Role of SOs

• CBS Sub Post offices

will send only Banking Cheques collected in

Savings Bank counter to their concerned Head Post Office invoicing in List of Documents on same day of

collection.

• Non POSB branch

cheques will be sent to HO separately which will not be included in CTS Clearing.

• SOs will maintain

register as detailed in SOP for cheques received for POSB operations.

• Sub Post Offices to

check ledger of concerned office account

(0382/0322/0410/BDPVT) on T+2 days using menu HACLINQ to check whether the cheque sent out for

clearing has been cleared.

• Alternatively they

can check the status of the cheque by downloading PO Clearing report in Finacle.

• If credits are

available, sub post offices can open new accounts or complete subsequent deposit transactions in

Finacle.

Role

of HOs

• HOs shall use CTS

application only for scanning of cheques

• User Name for CTS application

(M-

MICR ) for maker

&

C-MICR

for Checker

with their given password which is already

provided to all Hos.

• Ensure cables in

Cheque scanners are connected. Error“UNABLE TO CONNECT TO THE SORTER. SORTER IS

DEAD” will be thrown if not connected

properly.

• Hos to ensure that

Scanning/MICR Repair/Account Entry and

Verification process for outward cheques to be done before 1700 hrs. Post offices will not be

allowed to perform any of the above said

CBS-CTS operations after the cut off

time.

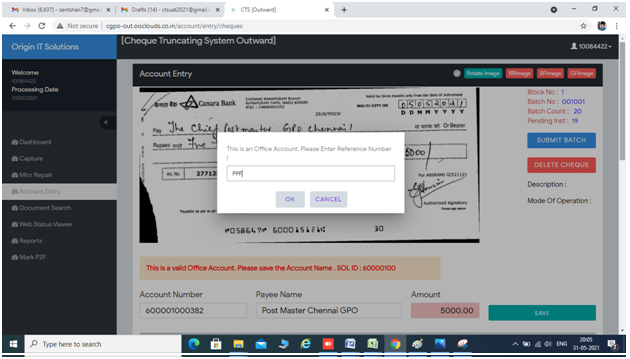

Account

Entry – Validations

• Necessary validations

have been built in CTS application to validate SB account number and office account in

which the cheque amount is to be

credited.

• Closed

account/Dormant accounts/Frozen/Non CBS /Invalid account number could not be entered in Account

entry. Appropriate error message will be thrown if above accounts are entered.

• Non CBS cheques

should not be scanned. These cheques should be sent for clearing in their associated

banks. (Postmaster’s Account)

• Existing procedure of

scanning remains the same.

• Post scanning, MICR

Repair to be done for ALL the cheques. Currently MICR repair is done only for

those MICRs which are incorrect.

• Once MICR repair is

completed, all cheques will be available In Account

Entry

• In “Account Entry”

module – either Savings Account Number or Office Account (Sol ID + 0382/0322/BDPVT/0410) to

be entered.

• Once account number

is entered, if account number is valid, a message “This is valid CBS account. Please save

the amount and account name” will be

displayed.

• Scheme code and Mode

of Operation of the account will be displayed on the right side.

• Name of primary account

holder in the Payee name field. User to cross check whether name matches with payee name

written in the cheque for Savings

account.

• If the cheque is

issued for joint holder, payee name should be changed.

• Users should enter

the payee name as in cheque to avoid return of cheque for payee name incorrect reasons.

• In case of office

account, “Postmaster followed by concerned PO name i.e. Postmaster Anna Road will be

displayed as Payee Name

Account

Entry - Screen

Office accounts

• Once amount is

entered, “Save” icon should be clicked.

• PAs / Supervisors

should ensure that amount in the cheque is encoded in the application. In case of any

encoding errors, the Scanning Post

office will be held responsible to clear the same.

• When we save the

details of an Office Account a text box will be prompted to enter the reference

number. Ref Number is mandatory for

PPF/SSA subsequent deposits. PPF or SSA

account number is to be entered as reference number. In case of new account,

MIS/TD/KVP/NSC New account to be

entered

Text

Column – Account Entry

• A cheque can be deleted if anything found

wrong in “Account Entry” module by clicking “Delete Cheque” Icon.

• A batch can be submitted only when all the

cheques are either saved or deleted.

• After account entry is done, the

verification has to be done by supervisor for each and every cheque.

• The Supervisor should login with the given

Credentials (C-MICR). The Dashboard indicates the cheques available in each and

every module of a PA.

• Supervisor to check the account number

/office account to be deposited, date of

the cheque, amount of the cheque. The PA/Supervisor should ensure that post dated / stale cheques are not uploaded

and should also ensure that the office

account cheques are entered correctly.

• The supervisor should ensure that the number

of cheques scanned and amount tallies.

• Supervisor should ensure that all the

batches are submitted before the cut off time.

CTS

Reports

• Outward Presentment Clearing Detailed Report

–

Total Outward cheques scanned by HOs.

This report is accessible to restricted class of users. All HOs can download the report

after the cheque is scanned. The status of the cheque will be updated every now

and then once the same is moved from one

module to another. Finally, on the next

day the HO can find out whether all cheques are cleared. In case of extensions, the credit will not be

given to those accounts by GPO

• Outward Item Summary Report -

This report consists of summary of cheques received date-wise.

•

CHI Rejection and Deleted Report – This report consists

of CHI Rejections by NPCI and Deletions

made by Vendor due to various reasons.

The HOs should check this report daily and ensure that the cheques are either rescanned after making

necessary alterations or returned to the customer with reason mentioned.

• Return Memo: This

is a valid return memo given by the banker. These cheques are cheques that are returned by

the banker and hence will be returned

by Chennai GPO in the Inward Zone maintained. The copy of the return memo, duly attested by the

Supervisor should be handed over the

customer. Collection of charges for accounts other than SB may be done as per the existing

procedure.

• Returned Item Detailed Report

– This report con sists of Cheques returned in the presentation Session of the

previous day. HO can download this

report and confirm whether the cheque is marked as rejected in finacle.

• Inward Reject Summary Report

- This report consists summary of cheques returned date-wise.

• Batch Summary Report –

This report is the report of cheques scanned in Batches.

Finacle

Reports

• Finacle (HFINRPT):-

• Post office clearing Detailed Report:

• This report will be available in HFINRPT and

provides us the list of all cheques

that are received for clearing or sent for clearing on the particular Day. Either Inward or Outward can

be selected.

•Respective Grid Sol ID

(Chennai GPO (6000010)/Mumbai GPO(40000100)/New Delhi GPO (11000000)

should be entered for generating this

report

Post office Clearing Detailed Report

• PO Clearing Summary Report

• This report will

provide the summary of cheques received

and cleared w/r/t both inward and

outward cheques.

Download PDF File:

0 Comments